Unlock with AI

Every year, businesses miss out on billions in hiring-related tax credits. HireProfit identifies and files for those incentives on your behalf — with no disruption to your team.

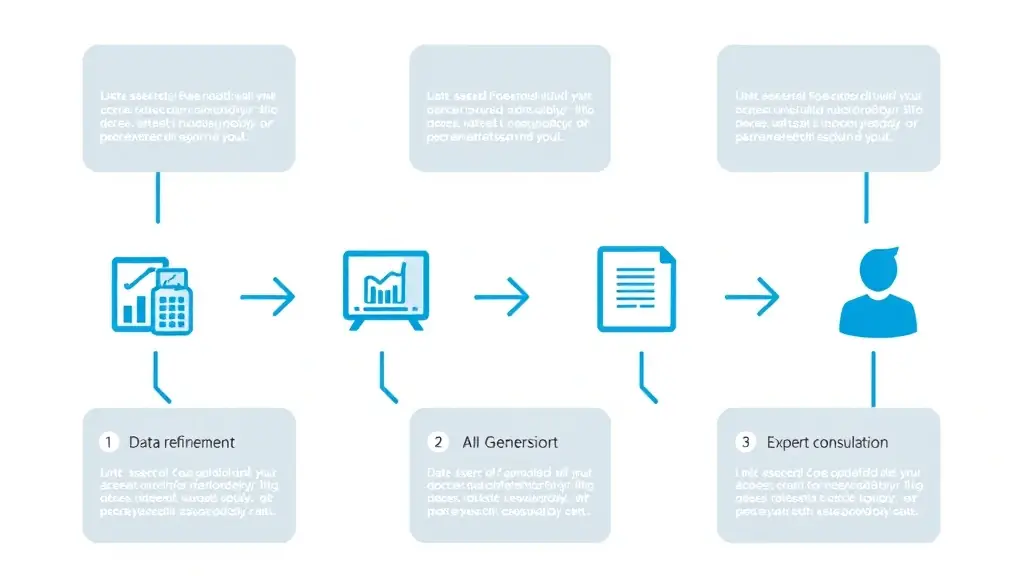

Our Process for Maximizing Your Tax Credits

HireProfit simplifies the complex world of tax credits and incentives. Our platform guides you through each step, ensuring you don’t miss out on valuable financial opportunities. Discover how our AI-powered system works for you.

Step 1

Sign Up Free. No credit card required. Answer a few questions about your business.

Step 2

Invite candidates to HireProfit for analysis. We only gather the required data to identify your potential hiring credits.

Further Steps to Maximize Your Credits

Following the initial steps, here’s how HireProfit continues to work for you:

Step 3

Automatic Screening of Every New Hire – Our AI handles the heavy lifting identifying WOTC, State based grants, Zone-based incentives, and industry specific credits. Never miss another credit.

Step 4

We handle the forms – You stay focused. We take care of generating the forms for compliance so you can file and get the credits you deserve.

Step 5

You Get Paid – Approved credits reduce your tax liability — or deliver a cash refund. Either way it’s money in your pocket.

Step 6

We Monitor, Update & Repeat – Hiring is an ongoing activity. So is credit eligibility. We monitor at the Fed and State levels for credit program changes and automatically scan your employees for eligibility.

Ready to Start Maximizing Your Hiring?

Still not convinced?

“Over 85% of eligible Work Opportunity Tax Credits go unclaimed each year—costing employers billions in missed savings.”

— U.S. Government Accountability Office (GAO), Congressional Research